With a wife and two little girls in the house, sometimes I go out and mow the lawn whether it needs it or not!

All joking aside, it’s nice to get out there on a beautiful day and cut the lawn.

It takes me about an hour to do my lawn. That translates to a lot of thinking time almost weekly during roughly half the year.

And what do I think about?

Well, since I’m a big nerd (just ask my wife) I think about personal finance. And Disney. And personal finance.

Mowing my lawn reminded me of one of the biggest lessons I’ve learned in personal finance.

The Big Lesson: Look Straight Ahead

There’s something satisfying and beautiful about a freshly cut lawn with straight lines from the mower, but getting those lines straight is a lot harder than it looks.

So what’s the secret to getting those straight lines even when you’re dealing with unlevel terrain, rabbit nests, bees, and trying to make sure every last blade of grass is cut?

The key is to look straight ahead.

Focus on one point and then walk toward it.

When you’re trying your darnedest to get those straight lines by looking down and making sure the wheel is exactly where it needs to be, you are never going to have straight lines.

But if you focus on one point every time you turn around, you’ll have a straight-lined, immaculately cut lawn in no time.

Just like with mowing, the best way to meet your financial goals is to look straight ahead and stay focused on your goals.

Keeping your financial goals in the line of sight mentally is the quickest way to create a straight line. And the quickest path between two points is a straight line.

When you stay focused on your goals, things around you tend to fade away. Suddenly, that shiny new “insert-object-of-your-desire-here” doesn’t look so nice stacked up to a goal of more spending money, true financial freedom, or being debt free.

Keep your financial goals in sight and it will help you make the best decisions to get to them quickly.

But how do you do that?

How to Stay Focused On Your Financial Goals

I’ll tell you one thing—it’s hard to stay focused on your goals.

To get perfectly straight lines when lawn mowing, your goal is to find that point and remain focused on it. But crap happens.

You may step on something squishy and wonder what it was (oh no, the rabbit nest!). It’s possible that you might forget to lift your foot all the way up and almost trip.

The lawnmower may make some funny noises or run out of gas.

There will always be things that take your focus off of your goal—and that may happen even more for your financial goals.

Here are three ways you can stay focused on your goal even when things happen around you that threaten to take your attention.

1. Use Reminders

One of the ways I coach people to turn their stress from debt into motivation to pay it off also works for staying focused on your goals.

Give yourself reminders.

To reach your financial goals, consistently remind yourself where you want to be. Not only that, remind yourself how far you’ve come already.

This could be as simple as leaving yourself a sticky note on your computer monitor that reminds you of your goal.

You can use your phone’s reminders or to-do list app to remind yourself of your goal frequently.

If you want a more boisterous reminder, set the alarm clock on your phone to go off every few hours with the alarm label matching your goal. When the alarm goes off, it will tell you what your financial goal is—loudly.

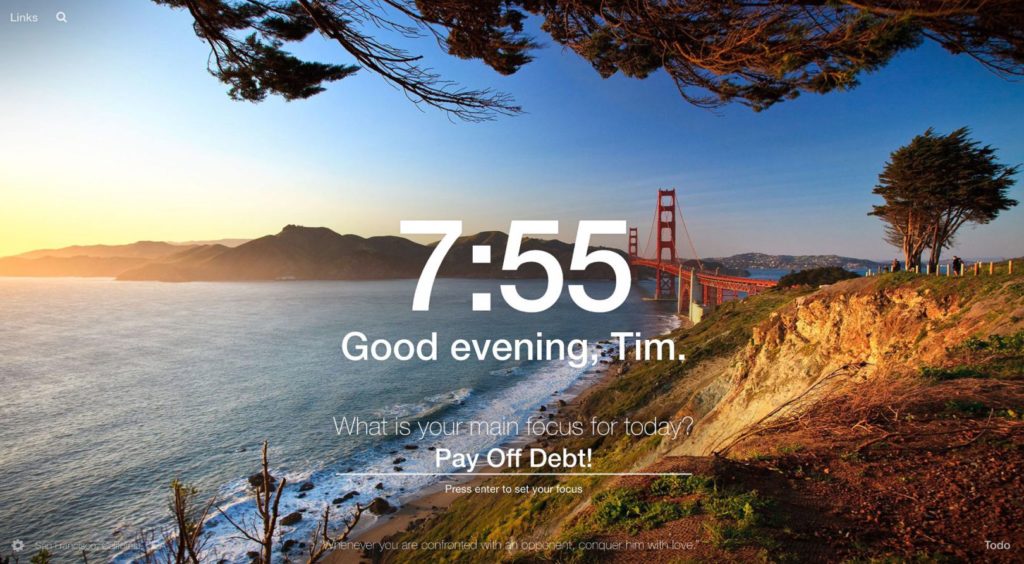

You can also download an inspirational dashboard Google Chrome extension. The one I personally like is Momentum.

Momentum gives you a gorgeous picture with a clock and greeting.

There’s a section underneath the greeting where you place your focus for the day.

Place your financial goal in that slot, and every time you open up a new Chrome tab or window, you’ll see a beautiful picture with your goal front and center. #motivation

There’s also a to-do list in the bottom right-hand corner if you want to use it for that as well.

Do—and use—what you can to remind yourself of your goal often to help you stay focused.

2. Use Milestones

If your financial goal is analogous to making it to the top floor of a building, then milestones are the landings that help you get there.

When you’re cutting the lawn, your main goal is to get the entire lawn cut. You can’t just pick one spot ahead of you and then use that one point to get the whole lawn cut.

What you have to do is focus on one thing, get the straight line, then turn around to focus on something new to go back and get a straight line in the opposite direction.

These smaller focuses are like milestones.

Milestones are essentially smaller goals that help you reach your final overall goal or destination.

This gives you smaller wins to celebrate and motivates you to keep moving forward.

Let’s say you’re a basketball player who’s a little bit on the shorter side compared to all of your 6 foot 7-inch friends so you set yourself a goal to get really good at making three-point shots.

Now your goal and focus don’t change, but in order to start small, you might start by practicing your free throw shots and getting really good at those.

Once you hit that milestone of shooting amazing free throws, you may move back just a little bit and get good at shooting from there. You hit that milestone and you keep going.

You do all of this while keeping your goal of being an amazing three-point shooter in mind.

The milestones continue to motivate you and further your focus on your goal.

As you hit each milestone, as you climb each step, your confidence level rises. You say to yourself “I’ve done all of this so far, I can keep going!”

Before you know it, you’re one of the top three-point shooters in the league.

And before you know it, you’ve reached your financial goal.

3. Share Your Goal With a Friend

Accountability is one of the biggest keys to staying focused on your goal.

Sometimes, when you get in the thick of things, it takes an outside party to bring the focus back in and remind you of what you’re really shooting for.

It’s someone to say, “Hey, how’s your lawn looking this week?”

Have a friend you can trust and speak with them about your goals at least once a month.

This accomplishes two things.

First, you actually have someone you are reporting your progress to.

There is a certain level of embarrassment (of the good variety) that occurs when you tell your accountability pal that you’re going to do something and you don’t do it.

When you are “disappointing” someone other than yourself, you’ll try and do what you can to avoid disappointing them.

At the same time, the person you are confiding in will be there no matter what and help you along the way whether you have a bad month or not.

In fact, they will be able to shift your focus from the things you didn’t accomplish to the things you did accomplish.

This helps you stay motivated to keep going.

Second, when you are doing things that may not align with your ultimate goal, you may not even realize it.

Talking with your friend about your goal and your progress will give you an outside perspective from someone who really cares about your best interest.

They can help point you in the right direction and tell you things like, “This may seem like it’s getting you closer to your goal, but it’s actually taking you in the opposite direction.”

Or they may tell you, “What you’re doing is perfect, but you’re spending a little too much time thinking about it. Why not move on from this particular milestone for now?”

Don’t forget to offer to hold your friend accountable, too!

Final Thoughts

In order to get those straight-as-an-arrow lines when you’re cutting your lawn, fixating your gaze on one point is the way to do it.

When setting personal finance goals, fix your gaze on those goals as well.

Remember, the shortest distance between two points is a straight line. Keep your focus on your goals to help you create those straight lines needed to reach them quickly.

To stay focused, remind yourself of your goals consistently, keep track of (and celebrate) your milestones for motivation, and have a friend hold you accountable.

You’ll have a freshly mowed, beautifully completed financial goal in no time.