Hey all! I’ve got a guest post today from my good friend Vernon Johnson! Vernon writes on Medium.com (where this article originated) about work, life, and productivity. Check out his page for more awesome articles. But first…enjoy this one!

As Kanye has been known to say “I’m livin’ in that 21st century, Doing something mean to it.” One of the benefits of living in this wonderful century is we’re inundated with apps and tools. None more so than with our finances. We have so many resources at our disposal it’s no wonder we suffer decision fatigue and paralysis.

I’m sure you already have some favorite apps and tools in your arsenal (if you don’t be sure to sign up for the atypical newsletter). Today, I want to share a few of my favorite lesser-known tools. Some of them I use all the time, others I use once a year, but each of these tools has helped me immensely and I hope they can help you too.

#1 — Prism

I’m going to make a pretty broad assumption here. If you’re reading this and mentally more mature than Kanye West you likely have bills to pay. Deep down we’re all basically Lunchmoney Lewis without a recording studio.

I’m going to make a pretty broad assumption here. If you’re reading this and mentally more mature than Kanye West you likely have bills to pay. Deep down we’re all basically Lunchmoney Lewis without a recording studio.

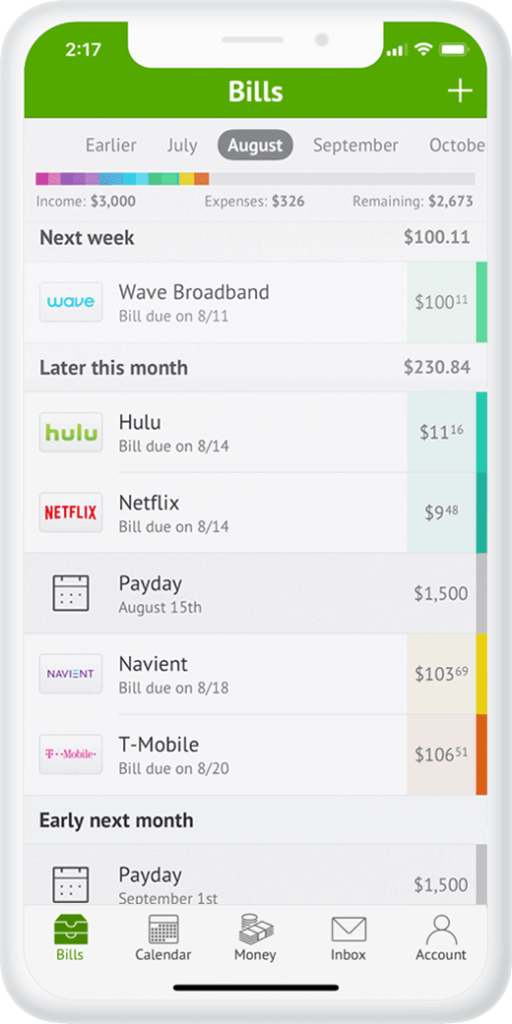

Now, bill’s can be one of the easiest things to waste money and time on. At worst you pay them all individually when — or after — they’re due. On the other end of the spectrum, you may have everything on auto payments and you occasionally check in on things to make sure nothing’s out of the ordinary. Whatever side you land on, you can benefit from the app Prism.

Prism shows you when your bills are due and allows you to set up payments. There are two main reasons I love prism. The first is I can set up all of my payments at the very beginning of the month and choose when I want them to be paid (as in before their due, or on a payday for instance).

The next reason I love prism so much is the main reason why everyone should use the app. At a glance, I can check to make sure nothing is out of the ordinary. Some of us may not want to see how high our electric bill went up in August, but it definitely helps your financial stability to know. Even if all your payments are on autopilot, checking to make sure everything is normal saves you a ton of hassle down the road.

This app was also a huge time saver when my wife and I were in aggressive debt payoff mode. Because you can see everything in one place, if we had an extra $50-$100 suddenly, it was super simple just throw it at one of the credit cards.

What’s amazing to me about all this is that prism is completely FREE! They are paid by your billers to offer easy options for you to pay. You will need to double-check with some of your billers because in some instances they may tack on a fee for using outside services or paying via your bank account.

#2 — Amazon Export

I know, it’s a little weird, but let me explain. Not everyone is a zero-based budgeter where you budget every dollar that comes in and goes out. But if you are, this one is a lifesaver.

Like most Americans, my wife and I are Amazon prime members and often find blue taped packages at our door. The problem is, we end up with a ton of Amazon statements in our bank account with no title or indication as to what it is.

I would spend a lot of time trying to match the price they charged me with the invoice, but if they split up the items in your order, I’d be billed separately which doesn’t show on the invoice. Also, if I used a gift card it wasn’t always clear on the invoice so I’d have to negate that from the total at the bottom. Needless to say, it was very annoying. If you budget every amazon transaction, I’m sure you know what I mean.

That’s when I found this little known reports feature of Amazon. You can export the report to show every transaction price. This helped SO MUCH when trying to budget amazon orders throughout the month.

#3 — Debt Reduction Calc

If you’re reading this, there’s a good chance you’re a finance nerd (UNITE!! ✊). I LOVED this google doc template when we were knocking out our debt.

The doc is so easy to use despite using some complicated formulas. You first list your debts, the interest, and how much you owe. You can then choose the debt payoff method you prefer and it will show how much interest you’ll pay and how long it’ll take to pay off your debt.

For my wife and I, it was very nice to reference every month and incredibly motivating.

Get the Debt Reduction Calculator

#4 — Fund Fees Calculator

Let me ask you, do you know the total amount of annual fees on your 401k investments? If not, don’t worry. I didn’t have any idea until a few weeks ago (thanks to Tim Jordan). However, I’ve come to realize how much it pays to know.

Let’s explain the fees super quick. Most mutual and index funds charge a fee called an “expense ratio” (or management expense ratio). This is the fund’s annual fee and it can range from 2% to .04%. It’s paid out through the returns of your fund.

This money goes towards a few things including the fund manager, administrative costs, and a distribution fee that’s used to advertise your fund.

You may be thinking “2%!? Why are we even talking about 2%!?” Well, because it’s not really 2%. Sure, let’s say you’re on track to have $2,000,000 in retirement by the time you turn 67. 2% of that is only $40,000, right? WRONG.

You may be thinking “2%!? Why are we even talking about 2%!?” Well, because it’s not really 2%. Sure, let’s say you’re on track to have $2,000,000 in retirement by the time you turn 67. 2% of that is only $40,000, right? WRONG.

If you put away $550/month from the age of 25–67 and assumed 8% annual return, you’d have somewhere around $2.1million. That’s beautiful. Now, what about that 2% fee. The reason it’s not just 2% is that it takes money that would have otherwise compounded. So that 2% fee cannot compound for 30+ years anymore.

So with a fee of 2%, you wouldn’t have $2.1 million anymore. You’d have… $914,836. Which breaks down to $301,374 in fees, and a whopping $795,315 in OPPORTUNITY COST! That’s a 58% LOSS from where you could’ve been.

Now if you invested in low-cost index funds that have fees somewhere below .2% (that little dot really makes a difference) you’d have $1,904,572 by the time you retire having only paid $34,763 in fees and $72,195 in opportunity costs.

Friends, it PAYS to know your fees. If you’re paying high fees, look for low-cost alternative index funds and switch quickly!

Get the Bank Rate Fund Fees Calculator

#5 — Privacy.com

This last one you may have heard of, but I want to show why it’s amazing for 3 other reasons I’m sure you haven’t heard.

If you haven’t heard, Privacy.com is a service which allows you to generate cards for specific purposes. So you can generate a card specifically for your Netflix subscription, gas bill, and that random online store you just found. One of the reasons for this is security. If someone hacks Netflix and steals my payment information they have that privacy.com card which I’ve restricted to $13/month limit and can only be used on netflix.com. So if my card were stolen I don’t have to waste precious hours with my bank getting new cards and changing all of my other subscription information to the new card. Eat dirt hackers!

This leads me to reason number one. You never have to worry about changing cards or banks. This recently happened to us. Our bank sent us new cards and said something along the lines of “we noticed some unusual activity and replaced your cards for you.” It’s such a hassle. Now I have to go in and change all of our online subscription payments. And next month I’ll get emails and letters saying they couldn’t process the card on file because I had forgotten to update that one.

Enter privacy.com. When we got those new cards I didn’t have to do ANYTHING! NOTHING! NADA. Because privacy.com is linked to my bank account and not my cards, and I’ve generated cards for all of my online subscriptions, they all processed and went through as normal. Listen! I couldn’t buy that peace of mind.

Now the second reason is similar but still important. For years banks have been making it harder and harder to leave. I mean think about it, it’s already hard to leave because that bank account is tied to YOUR money. I brought up switching banks with my wife once and you would’ve thought I had punched her in the stomach. It wasn’t that she had any real attachment to the institution, but the hassle of switching sounded like self-torture. With Privacy.com, it’s so much easier. I just plug in the new bank account, set it as the default, and just like that all those cards use the new funding source.

Now the final reason. But before I share my third reason, I need to offer a bit of a warning. This should only be used when absolutely necessary. Making a commitment to pay someone a specific amount of money over a specific amount of time means you gave your word, and you need to follow through on that. Don’t trade your integrity for cash.

With that, let’s move to the final reason to use privacy.com. There are some sleazy businesses out there. The ones I’m specifically talking about sign you up for a membership of some sort and then make it nearly impossible to cancel. There’s a gym some of my co-workers attend that said to cancel, you have to come into the main location (they had several all over Chicago) and visit with the manager… who conveniently was never there. Literally, he was only there for a few hours a day and it was never consistent. That’s borderline fraud.

So here’s what I’d do. Using privacy.com, I’d create a new card. Call up the gym ask them if you can switch the payment method on file. Now, of course, unlike canceling, this is something they let you do over the phone. Switch the payment to the new card, and then pause that card on privacy.com. The card will not allow the charges to go through and you no longer have to spend hours chasing down the manager.

Now, PLEASE, don’t use this as your new default canceling method. That’s wrong. But in the cases where businesses are trying to scam you into staying with something you no longer wish to or have an obligation to stay with, then this saves you hours.

Get Privacy.com – https://privacy.com/join/7E23T (Disclaimer: this link will give a small $5 kick-back to me, but it also gives you $5 too. Enjoy.)

I hope you found these tools and resources helpful in your personal finance journey. I’d love to know your thoughts in the comments, especially if there’s a tool you love, use, and swear by.