I’m a big fan of uniqueness. I believe in it so much that I use it as part of the foundation of how I teach people about finances. In fact, I love it so much that I made it one half of the title of my business.

The “atypical” in Atypical Finance is all about you being you like only you can.

What better way to teach people how to run their money in a way that makes sense for them than to get to know them personally?

I’m excited to announce that launching TODAY is a coaching program designed to do just that!

Starting today, you can participate in two separate coaching programs.

Single-Session Coaching

The first coaching program is single-session coaching. In these sessions, we’ll focus on a topic of your choice and getting you to a place where you can see results long-term.

Let’s look at an example of debt payoff. I’ll get to know your personal financial situation, show you how to use your budget to pay off your debt, and give you some strategies you can implement to pay it off faster than you thought possible.

I’ll even show you how to make it automatic to build in accountability. This makes it easy to just stick with the plan and change your life by paying off your debt.

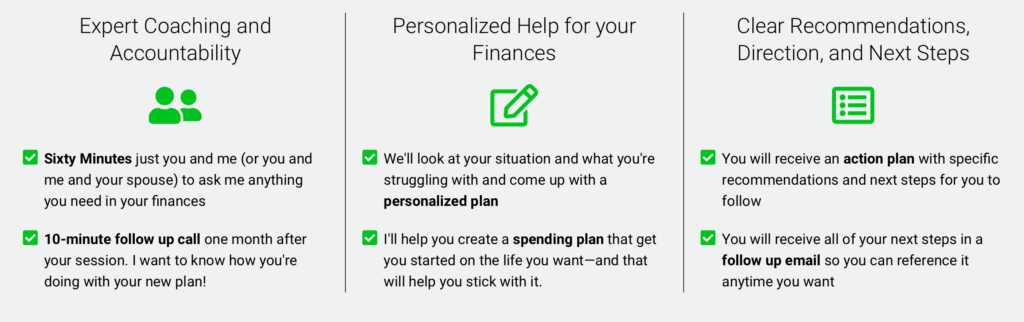

Single-session coaching sessions are 60 minutes long with an option to purchase a half hour or an hour extra at a discount.

Here’s what you get with single-session coaching.

Single sessions are great for you if you aren’t sure where to go next in your finances, want your money to stop keeping you up at night, or what someone who’s been where you are to help you on a path of getting out of your current situation.

I love coaching people like you on how to better themselves financially and master their money. Single sessions are a great starting point for anyone to take advantage of and I’m excited to work with you in this capacity.

Your investment cost for an hour of coaching with me is $199. You can schedule your session by clicking here.

But what if you’re ready to go deeper right away? What if you’re ready to get COMPLETE control of your money in just 90 days?

That’s where my second coaching program comes in. Introducing…

The Master Your Money Coaching Program

This is where the BIG change is guaranteed to happen!

If single-session coaching is like getting my help for an hour (or two and a half with the work I’ll put into one session with you), the Master Your Money Program is like getting me for three whole months.

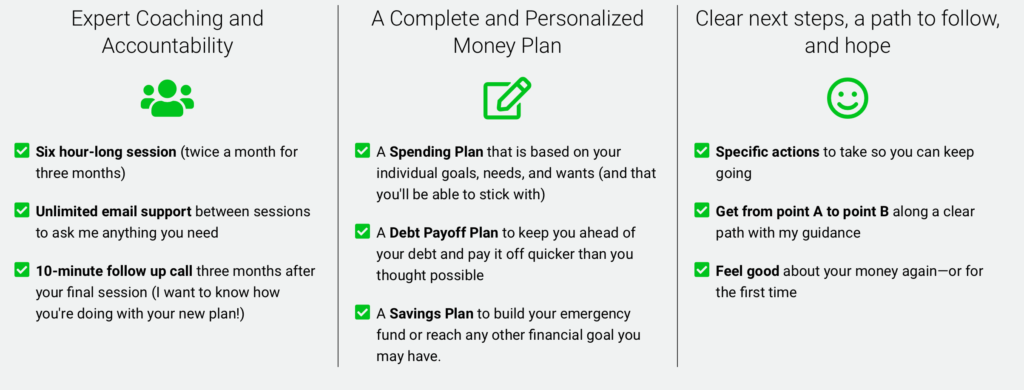

You get three guaranteed things as part of the Master Your Money Coaching Program.

- A Spending Plan that is based on your individual goals, needs, and wants (and that you’ll be able to stick with)

- A Debt Payoff Plan to keep you ahead of your debt and pay it off quicker than you thought possible

- A Savings Plan to build your emergency fund or reach any other financial goal you may have.

You also get six 60-minute hour-long coaching calls with me, regular email check-ups and follow ups from me, unlimited email access to me for the entire three months (to ask me anything you need in between calls), and a 10-minute follow up call after our final session. I want to hear all about your success and if I can help out further.

The Master Your Money Program is my signature program and perfect for you if you want to change your financial life for good. It comes with the teaching, tools, and accountability needed to help you create a budget that you’ll be able to stick with, get out from under your debt, and create the habits necessary to keep funding the life you want.

This is where the real change WILL happen. Your investment for this coaching program is $1,199 for the entire three months.

You can schedule your first session by clicking here.

Launching at a Discount

To celebrate the launch, I’m launching each of these programs at a discount!

Until the end of September, single-session coaching will be discounted at $50 for an hour making your investment $149. The Master Your Money Program will be a whopping $200 off bringing your investment down to $999.

But don’t wait to lock this price in. Starting October 1st, the price goes up to the regular prices mentioned above.

What Does a Financial Coach Do Exactly?

I’ve heard a lot of questions about what exactly a financial coach does. Am I a financial advisor?

The answer is no. Not in a traditional sense.

A financial advisor focusing mostly on investments. They can help out with budgeting and debt payoff but most of the time their primary concern is your retirement. They also sell investment products to help you get there.

As a financial coach, there is nothing incentivizing me but your progress. In my mind, if you do poorly, I’m doing poorly. I may recommend certain products that will help your overall health, but I don’t sell them directly.

I focus on budgeting because I believe it is the root of your financial tree and will help you in all other areas of personal finance—including your debt payoff, saving, investing, and retirement. Even careers are helped by budgeting.

That doesn’t mean I won’t help you out with figuring out retirement or other things. But as we work together, you’ll see how your budget will help you in all areas. We’ll use it to create the perfect debt payoff plan and inform every other area of personal finance.

Schedule Your Sessions Today!

You can also check out my philosophy on budgeting here.

I know I mentioned this before, but I love coaching people one on one. I’ve been doing it for years at work and on the side helping people with their finances for even longer.

Being a Certified Dave Ramsey Master Financial Coach, I want to help you take your money to the next level. I want you to be where you want to be in your personal finance and I want to guide you to that place.

Hiring a financial coach is a great investment for your finances. The cost is a small price to pay so you can save thousands on interest on your debt, earn interest on your savings, and be financially free.

You can stop living paycheck-to-paycheck. You can get that mountain of debt paid off quickly. And you can change your financial life for good, and by extension, build the life you want.

And I’d love to help you get there. 🙂

Don’t wait!