Hey all! I’ve got another guest post for you from my good friend Vernon Johnson! Vernon writes on Medium.com about work, life, and productivity. Check out his page for more awesome articles.

Do you even Lyft, bro?

I remember back in 2012 first seeing the strange pink mustaches on cars driving around Chicago. It was weird, but I instantly wanted to try it. Mostly because I love that we live in a world where we can get in a complete stranger’s car and we trust them. Come on! That’s weird, and it shouldn’t be. Thankfully, the economy and culture is changing/has changed.

For whatever reason, I didn’t sign up until April of 2017. Though now was as good a time as ever.

I had 4 goals and/or reasons for driving:

- Finish paying off one of our cars ASAP (we had roughly $1700 left).

- Get the signing bonus (to help with goal #1).

- Meet new people.

- Find out exactly how much Rideshare drivers make. (I’m a bit of a data nerd, so crunching the numbers got me pretty excited.)

I had these goals from the very beginning and I’m glad I did. These goals really pushed me even though there was some late nights, early mornings and a few hours of driving.

Almost every time I’ve gotten in a Lyft I’ve been that annoying person asking if it was worth it and if they thought they made good money. Rather than asking, I thought I’d just figure it out for myself.

So I went for it with the intention to share everything I’ve learned so you can get an honest opinion, a few tips no one else might tell you, and explain the real cost of earnings of driving.

The Data – Was it worth it?

To get my signing bonus of $360 I needed 120 total rides. (P.s. my signing bonus I can give out is actually more. This was the best they could give me at the time for some reason. (Clicks here to get up to $700 in the first 60 days.)

Time & Rides

A few notes about the time and miles here. I use Metromile for our care insurance which is a pay-per-mile insurance provider. This is helpful because it tracks the total amount of miles I drove, not just the miles driven with riders or en route. I’m trying to get a full understanding of the costs so calculating the total miles is crucial.

Same with the hours driven. This also includes the time it took me to get downtown Chicago from where I live (30 min average). It may take less time for you to get to the most populated area which means you’ll make more per hour ($$$).

I will take a minute here to mention the vast amount of variables that exist here. Prime-time, power drive bonuses, surge pricing, special events, getting shipped out to O’Hare airport while the city is surging, etc. So take some of this with a grain of salt.

Earnings & Money

I drove a night without water and snacks and earned about $0.33/rider in tips. The day I introduced water, mints, and gum in the car I got an average of $1/rider in tips. (Hint: buy water, mints, and gum).

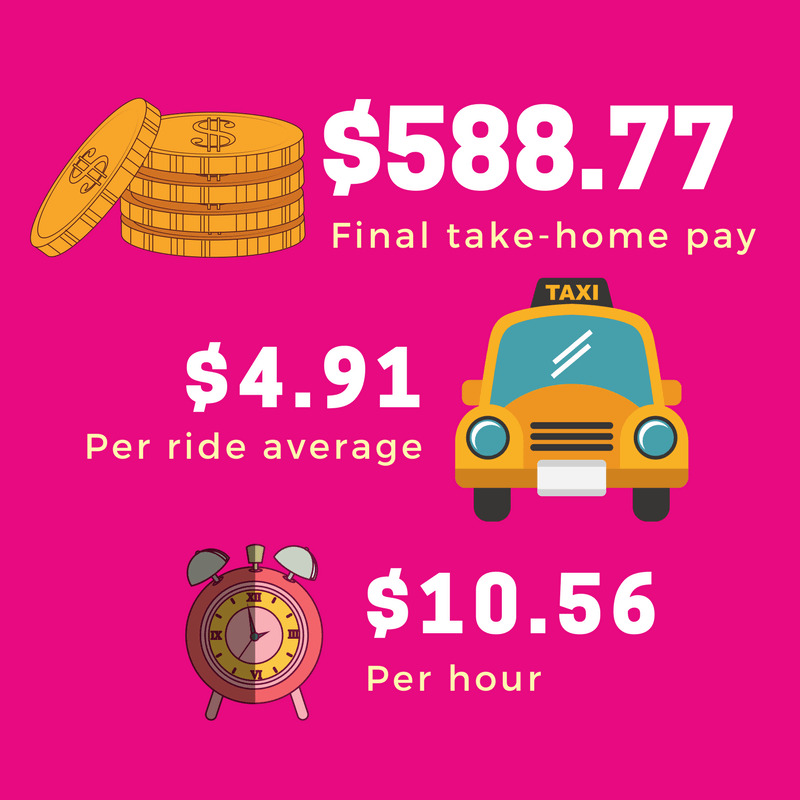

The $1131.07 includes the $360 in bonus I received after completing 120 rides. I’m calculating from the data I have since there are so many variables that other drivers will encounter.

Costs

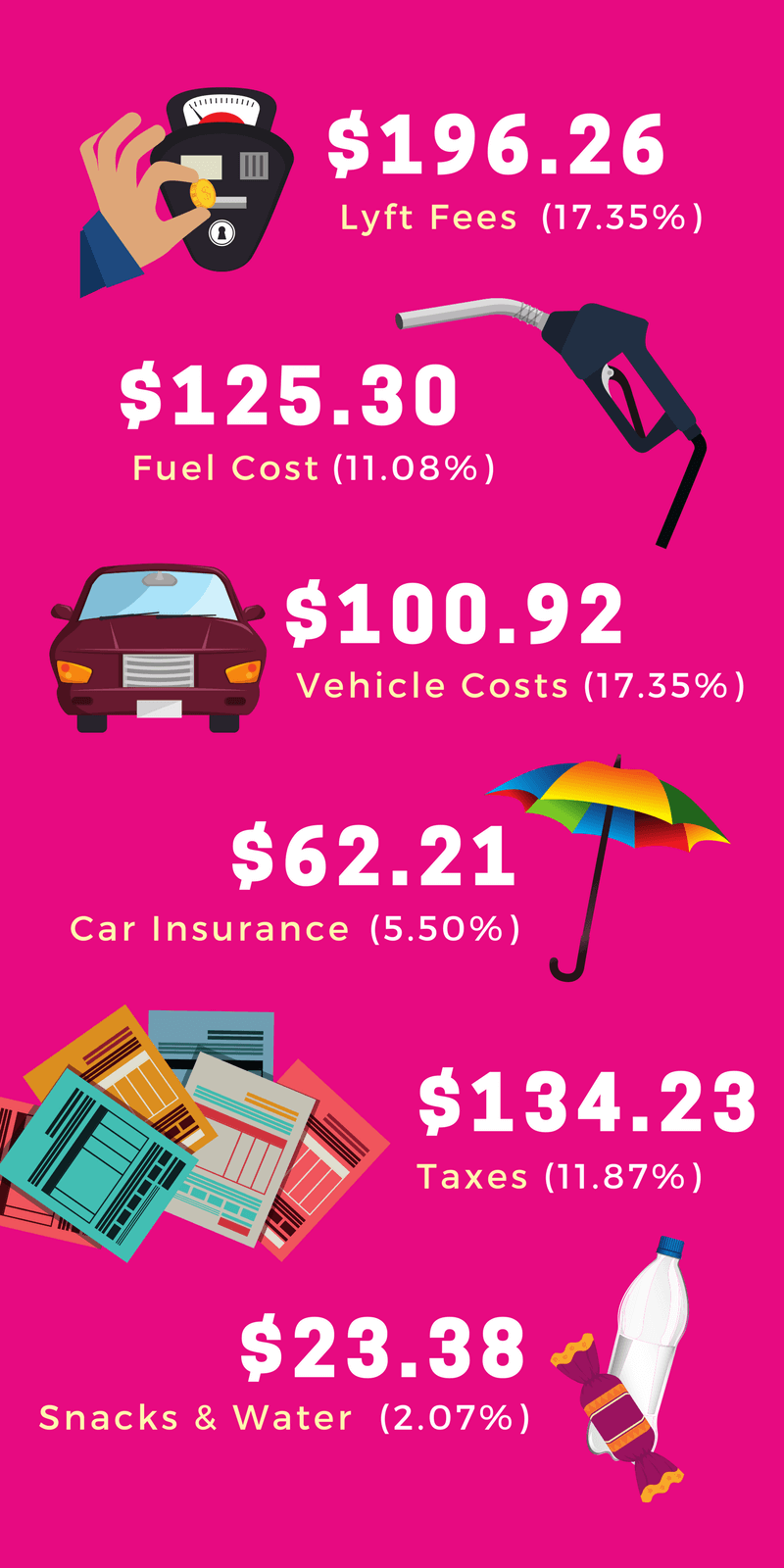

Allow me to explain some of the costs.

Lyft Fees: Normal Lyft fees are roughly 20%. I say roughly because for some reason it wasn’t always exactly 20%. The reason it’s less here is because of that $360 bonus.

Fuel Cost: This data came from Metromile, my car insurance provider. It’s able to track fuel consumption data in real-time and then multiplies that by gas prices when you fill in the area you filled up from. Not 100% accurate but probably within a $1 or 2.

Vehicle Costs: This number comes from several things. First, I need an oil change every 5000 miles which costs $60 with a coupon so that comes out to $0.012/mile. I then need new tires every 50,000 miles and they are roughly $450 which is $0.009/mile. I also had my car vacuumed at the local car wash which was $15. That brings us to $37.91. But the other cost I want to factor in is the loss in value from putting on 1000+ miles. This may not be an issue for you, but still a cost nonetheless. The value of the car started at $10,028 before I started and dropped to about $9965 according to Kelly Blue Book’s sell to private party price. That’s an additional $63 in calculated loss.

Car Insurance: As I’ve stated, I use Metromile which charges me per mile. I pay a $33.60 base rate plus $0.057/mile. The $33.60 is already a sunk cost since I budget that and would’ve paid for it regardless of driving for Lyft. So I only calculated the $0.057 mileage rate multiplied by the miles I drove since this was the additional cost.

Snacks & Water: I purchased two cases of water, some mints, and a couple packs of gum. I also stopped for food once since I was out driving for a while. I could’ve saved money and brought some food from home, but since I wouldn’t have stopped if I hadn’t been driving, I included it.

Taxes: I could be wrong on this figure. This was more-or-less a guess for me. I’ll lay out what I did and feel free to let me know if I did it wrong.

I drove 1091.4 miles multiplied by the government mileage rate of $0.55 is $600.27 in write-offs. My total taxable earnings were $1131.07, minus $600.27, minus the snacks and water purchased of $23.38, minus $60 oil change. This equals $447.42 taxable income multiplied by 30% is $134.23 in potential taxes owed. Lame sauce.

Conclusion

All said and done, I pocketed $588 and made about $10.56 an hour, just $2.31 over the minimum wage here in Illinois (and that’s with a bonus!). If I run the math without the bonus it came out to $8.45/hour.

Tips for Drivers

I want to leave you with a few things I learned in my short time as a driver. More seasoned drivers may have better tips, but I’ll share what I learned.

#1 — Buy a bag of individually wrapped mints, gum, a car air freshener, and a case of water.

The first night I went out I did not have any of this. It was fine, I was just a normal driver. I realized what I missed when I did go get a few amenities and people were so grateful. In fact, I made WAY more in tips when I offered the mints, gum, and water than when I didn’t. I don’t have a ton of data from both sides but I earned $0.33/rider in tips without mints and an average of $1.00/rider in tips with. That’s a 200% increase in tips! Well worth the $15 I spent on everything.

#2 — DON’T CHASE THE SURGE!

I have a feeling Wayne Gretzky would be a great Lyft driver. I tried “skating” to where the “puck” was and I always regretted it. The surge zones change by the minute. Chasing them is futile.

Instead, work your city and get a sense of timing for them. There is a pretty sure pattern for surges and you’ll start to get a sense of where and when.

When you learn the city, “skate” to where the “puck” will be. In Chicago, Wicker Park lights up from 7–8 pm and then from 10–2 am on Fridays. Get there first instead of chasing it. There are times when it makes sense to turn off driver mode and head back to the main surge zone.

If a ride takes you outside the city and the city is lit, then shut off driver mode and get back fast. You’ll make more that way anyway. But, other than that scenario, never chase the surge. Anticipate it.

Also, check for key events in your city. If a show is set to get out at a certain time or game is starting or ending, be ready and be there.

#3— Airport runs are risky.

One morning I had a ride out to O’Hare International airport, the bigger airport here in Chicago. I got shipped out there from downtown around 7 am so by the time I got out there the city was surging and with traffic, it was an hour back in. I decided to head to the TNP lot and test my luck. SUPER BAD DECISION.

I arrived at 7:15 am with 65 cars ahead of me. The nice thing is they had bathrooms and a Starbucks truck. My hope is that I would get paid to go back into the city and the payoff would be worth the wait. I knew it was risky.

At 8:15 am, 1 hour after I arrived, it was down to 27 cars. That’s roughly a car every 2 minutes. Things picked up a little though. At 8:20 there were 23, 16 cars at 8:25 and then when it hit 14 cars at around 8:28 the app told me to leave and head for the airport. It said I wouldn’t lose my spot in line. So I jetted out of there (an hour and 12 minutes later) and did 3 loops around the terminals before I got my request.

I knew something was strange right away though because the request was just outside the airport. Zooming in further, I saw it was an Enterprise car rental location. I picked them and it turns out they just went to the wrong location so it was a 10-minute drive, for a grand total of $5.50 in earnings after Lyft fees. The couple was nice and gave an extra $5 tip. So even with the tip I made a really nice $6/hour.

I know this was just 1 ride! And there were LOADS of drivers in the lot so it is obviously worth it on some level. My only point is that it’s risky.

The only way to average out the risk is to do a ton of rides so you get those nice payoff rides. The other frustration was that the city was surging while I was sitting in my car for that hour. I’d avoid it, in my opinion, unless you can do enough rides to minimize the risk.

#4 — Try not to drink too many liquids and pick a few good bathroom spots.

This is pretty obvious so I won’t spend much time on it. Try your best to double using the bathroom with eating or grabbing a coffee. Double up efforts, stretch your legs, and get back out. In Chicago, a lot of McDonald’s have parking lots and great bathrooms. It provided a fantastic little break when I needed it.

#5 — Let the passenger dictate the mood.

At the beginning of every ride, I would say hello and ask how they are with enthusiasm. Their response gives me a good indication as to what they want. Let them dictate the mood, based on their body language.

Always be ready to chat, be a good listener, and respond well. People have told me about promotions they are trying to get, problems with their boyfriend, and working as an immigration lawyer under our current POTUS. You’ll hear some amazing stories if you listen.

#6 — Pick great underwear.

You’ll be driving for a long time and you don’t want your panties in a bunch.

In closing

I’m not advocating against Lyft by any means. If it’s worth the $10.50 an hour, or you can change the variables around and make more per hour, then it’s certainly viable.

Driving full-time with a more gas efficient car with a simple base-rate insurance company could really increase your potential hourly earnings. I’ve just synthesized the data I have from driving.

All-in-all I probably wouldn’t do it again. The amount of fun I had driving around Chicago, meeting new people and having the opportunity to just talk with them was incredibly fun, but it took a ton of time.

If you love meeting new people and have plenty of time, then I can certainly advocate for it. I did maintain a 5.0 rating which I’m pretty proud of, though.

This article first appeared on Medium.com.