If you’re anything like me then you have been mad at yourself at one time or twelve for acquiring so much debt. You have thoughts of regret mixed with a bunch of “if only’s” and “why” questions.

Thoughts like “Why did I let myself get into so much debt?” or “I wouldn’t be struggling right now if I didn’t have this debt” are commonplace.

You could have debt regret because it can keep you from being able to afford a nice vacation or force you to continue working an unfulfilling job. It can keep you from giving generously to a cause or group you believe in.

It’s way too easy to beat yourself up about debt.

Do not be discouraged about where you are in your debt journey!

I repeat, do not feel discouraged.

Why? While it may be easy to beat yourself up over debt, what you are doing can be quite difficult.

Let’s make it easier and look at it a different way.

Personal Finance is Hard

Let’s start with some good old-fashioned honesty. There are plenty of aspects of personal finance that are difficult.

Spending money is fun.

Creating a spending plan, a saving plan, a retirement plan, wondering if you should take a new job or not, trying to find the best way to manage your money in a way that will work for you, and trying to reach your financial goals can all be pretty overwhelming.

Part of the problem is that we tend to look at the end result as the “success.”

We think that once our debt is paid off, then are we successful.

Success is not the end result!

Paying off your debt—or any other goal you set—is simply the result of a lot of little successes in your life. Just simply continuing to move forward, always learning, is success in and of itself.

Most, if not all, “successful” people had a lot to overcome before landing where they are with a company doing well, a lifestyle they wanted to lead, and a budget that works for them.

All of their successes are from not giving up—the writer who woke up every morning to write no matter what; the CEO of a software company who spent a lot of late nights learning and perfecting his craft; the musician who tirelessly played to crowds of single digits so his talent would continue to develop.

These are the stories we want to pay attention to and label as success.

With debt, the same concept applies. If you look at only the end result of where you want to be, you will continue to be discouraged.

A goal is not complete without a path to get there. A destination is not complete without the journey.

Celebrate Small Wins

One of the best ways to stay motivated to pay off your debt is to celebrate each milestone. I’ve written about milestones before as a way to help you stay motivated to reach a goal. Using each milestone as a step is key.

It’s like the landing in a staircase—a small break to gather where you are and redirect if necessary.

If you set your overall goal to be getting out of debt completely, your small milestones will be like steps or mini-goals for you to accomplish. Research shows that breaking down goals into smaller, more attainable chunks helps in achieving them.

This is why the debt snowball method is so effective. You start with the lowest bill, pay it off quickly, and it gives you a little shot of dopamine to keep going because you’ve already paid something off.

How to Break Up Your Goals

Just like with creating a budget that works for you, this should align with who you are and what you know about yourself.

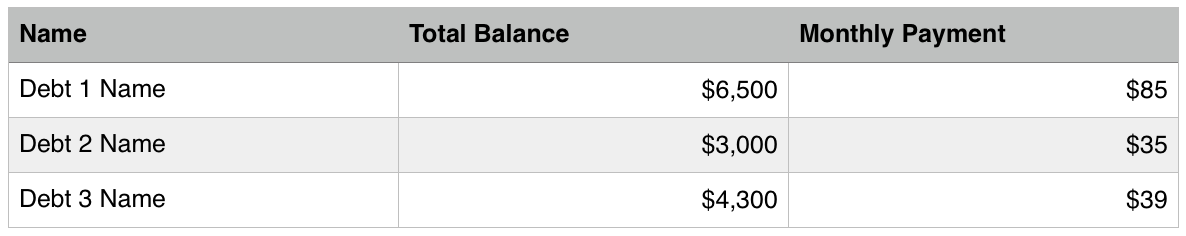

To start, list all of your debts in three columns. The first column will be the name of the debt—something like “Chase Credit Card” or “Husband’s Credit Card.” How you want to label it is up to you.

In the second column, label the total balance left on the debt. The third column is for your monthly payment.

It’ll look something like this:

Depending on your total balances, I recommend you start by setting each milestone or mini-goal to coincide with when you pay off each piece of debt. If you think you might get discouraged in that time or can’t put much toward your debt. You can make each milestone smaller.

Depending on your total balances, I recommend you start by setting each milestone or mini-goal to coincide with when you pay off each piece of debt. If you think you might get discouraged in that time or can’t put much toward your debt. You can make each milestone smaller.

For example, if you are making $150 payments on your lowest debt, you can set a milestone of $500 or $1,000. Once you make $500 or $1,000 worth of payments, you can reward yourself.

You can add a column to record your milestone in your table if you’d like.

Related: 4 Steps To Reverse Engineer Your Goals And Make Them Easier To Reach

How to Reward Yourself

How to Reward Yourself

When rewarding yourself, it’s important to limit yourself to smaller things that you really enjoy. You’re not going to want to pay off a $1,000 credit card and then take a $3,000 vacation to reward yourself.

What I like to do is use a portion of my debt snowball to reward myself.

For example, if you are putting $200 extra a month toward your debt and you reach your milestone of $1,000, you would use a portion of that to do something for yourself.

Perhaps, you would reward yourself with a $100 massage. You may really want to go out to a nice dinner, have an evening out with friends, or treat yourself to a $100 shopping spree.

Something as simple and cheap as treating yourself to a gourmet coffee may also work for you.

Align your rewards to who you are and what you truly value to make it the most impactful.

The important thing is to reward yourself for reaching these mini-goals. It’s a great way to keep yourself going.

Take a Step Back

If you take a step back and look at the big picture, you are able to examine not only the end result but also exactly how far you have come as well. You get the entire journey.

By taking a step back myself, I’m able to look at the fact that, yeah, instead of having $43,000 in debt like I did 5 years ago, now I have a little over $10,000.

That is a HUGE difference and should definitely be labeled as successful.

For every little success that you have when paying off your debt, try having a little internal celebration.

Reward yourself with something—your favorite dessert, a new clothing item, something you value.

Remember, success is not the end result but is part of the journey that you are taking.

It is in the milestones you reach. It is in keeping going when you don’t feel motivated to keep going.

This means that success is personal to every person. It could be that you have trouble paying your bill on time because of your money situation. When you are able to consistently make payments for three months, that is cause for celebration!

Your success could be each time you pay off a credit card. It could be that instead of putting more money on a credit card you decided to save a little bit this month.

It could be that you’ve learned to stay out of debt and can now use your credit card for rewards by paying off the balance every month.

Every small thing deserves a celebration. So don’t be discouraged. Every destination has a journey, and quite frankly, without it doesn’t mean nearly as much.