For a while now I’ve been thinking about doing a cash-only budget called “Envelope Budgeting.” If you’re not familiar with the term, “Envelope Budgeting” uses literal envelopes for each of your budgeted categories that you basically stuff cash in each month. For instance, for your grocery envelope, if you have a $400 monthly budget, you either place $400 in it at the beginning of the month or $200 in it at the beginning and middle of the month to correspond with when you get paid. Once the money is used up, you no longer can spend in that category.

The reason why I’ve been thinking about this is because it is a great way to keep your budgets in check. Think about it. You aren’t allowed to use any credit cards in this system. When you are using cash for literally everything, once the money is gone, it’s gone. No more putting it on a credit card after the budget runs out. No more keeping your money as a lump sum in your bank account so you have the ability to use your debit card when the budget runs out.

It’s gone.

Now to do this you have to be very disciplined with your money (or it will make you disciplined quickly!). You have to make sure you are budgeting the correct amounts. I recommend over budgeting just in case.

I would also recommend leaving your self some financial cushion to start as well. For example, if you are planning on having $300 leftover each month to put toward saving or debt, don’t starting using that money elsewhere right away. Leave this money in your bank account, potentially so you can use it in an emergency if you need to. There’s no sense in going hungry to try and start a new budget.

The Problem

Now as I’ve said, I’ve been thinking about this for quite some time. The problem for me is that I don’t like cash. I don’t think it’s a good idea to leave cash lying around in envelopes to get lost or eaten by animals or colored on by kids, or worse yet, stolen. Sure you could keep it in a safe at home, but that is still something that can be taken out of the house unless you have one built in.

However, the more I thought about a cash-only budget system, the more I wanted to do it. But I had to figure out the right way to do it.

The good news is, after testing for a few months, I’ve finally found a method that works.

My Method

So I like to call my method “Electronic Cash-Only Budgeting.”

Say what?

How do you use cash with electronic budgeting? Or how do you use electronics with Cash budgeting?

The answer is simple. What you do is treat your electronic budget like it’s Cash-Only. For example, whatever you use to keep track of your budget or finances, you would enter in your budgeted amounts right when you get paid. The beauty of this is that you don’t have to have a specific program to implement this in your system. This can just as easily be put in place in an excel spreadsheet as it would be in a program like Mint or Quicken.

Personally, I like to use Quicken to keep track of my finances. For each budgeted bill or item, I have a line in the check register section of Quicken that says something like “Budget – Grocery.” This is great because I automatically know that the line item I’m looking at is a budget item.

Let’s keep using a grocery budget as an example.

So I get paid bi-monthly and my wife gets paid every two weeks. Most months that means we each have one check toward the middle of the month that we would use for bills in the last half of the month, and then we have one check toward the end of the month that we use for the following months first half bills.

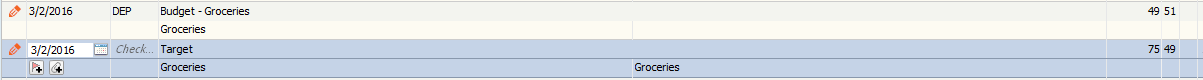

Whenever we get paid, I automatically put in our half month’s budget of $125. It looks something like this.

Whenever we go grocery shopping, even if it’s just for a few small things, I put the receipt in quicken just as you would a paper check register. Then I subtract the amount from my already entered budgeted amount of $125. It would look something like this.

So the blue line is the grocery receipt from shopping at Super Target and the line above is the change grocery budget with a new date of when it was last updated, i.e. when I went shopping. Pretty simple, right?!

This way, when it’s time to go grocery shopping, I know exactly how much I have to spend on groceries. I can keep track on the calculator on my phone as I’m shopping and know I won’t go over budget.

Now, using this method will give you the opportunity to keep your budgets in check as well. As I’ve mentioned before, since the price of a gallon of gasoline is so low across most of America right now, the amount of money you spend on gas on a monthly basis is probably significantly lower than what it was last year. Using this method, you will be able to see that your allowed dollars for gasoline continues to rise. You would be able to say something like, “I keep adding in $150 to my gas budget every month but I’m only spending $100.” In that instance, you can put that $50 to work elsewhere on cutting down debt or spending more in groceries, if need be.

Alternately, if you notice for a 3 or 4 months that you are not using all of your budget, you probably have a good $150 to $200 extra in there. What I did recently was take $150 from my gas budget and just used it to pay toward debt. I know I wouldn’t use all of it for gas so I was able to allocate it elsewhere. Imagine having to pull up a report to determine how much you are using in your budgets each month! This way is much easier.

So this is a lot like cash budgeting because it allows you to know exactly what you have in your budgets at all times. It also allows you to make a cold stop if you need to on all of your budgets or pull from somewhere else, if you need to.

At the same time, this has all of the benefits of technology. It’s nice to be able to pull up information on your phone to see how much you have left at any given time! Much better than waiting until you get home to check or play a guessing game if you forget to look before using one of your budgets. Also, say it’s a bad month for grocery shopping and you need to spend $50 more than you normally have budgeted. If you have instant access to your system on your phone, you can instantly see where you can pull money from in your other budgets to cover overages on groceries.

I’ve always liked the idea of cash-only or Envelope budgeting. Until now, I’ve never found a way to get it to work for me. This sort of method has had many other benefits as well that would be too numerous to list here. We’ll save that for another post.

For now, what is your system that you use?

Do you plan on trying this system? If you do, let me know how it goes!

Please, comment below!