Have you ever wondered what debt does to your mind? We all know (and feel) that money in general can have a very psychological impact. So how bad can it get with debt?

Think about your debt for a minute. What emotions does it stir up? It may stir up one or two, or it may stir up an array of emotions.

When I think of my debt, I get feelings of guilt, anger, and stress. I start saying things to myself like “How could I let this happen?” or “I’m such an idiot for getting into that much debt!” Sometimes, I can really beat myself up over my debt.

Other emotions that can be felt are fear, stress, denial, regret, panic, helplessness, and overall depression. Debt can be an ugly thing.

What if we were to turn that around? What if we turned all of those feelings around and used them as motivation and momentum for getting out of debt.

These feelings of helplessness and stress are powerful. If turned around, they can be equally as powerful in helping you pay off your debt.

Here are 3 ways that you can turn your feelings of depression into motivation.

Change the Stigma

In my article on reframing your debt mindset, I talked about how I don’t believe in “good” or “bad” debt. Good debt gives you a feeling of safety with your debt, allowing for the danger of keeping it around for longer.

Bad debt carries a stigma with it. If debt already makes you feel like crap, then using terms like “good debt” and “bad debt” will only make you feel worse, especially if you’re the one with the “bad” version.

So change the Stigma

The terms I like to use to describe debt are Unnecessary and Necessary debt. There isn’t good or bad debt.

For example, some mortgages might not be considered a “good debt” but it would be considered a necessary debt. The reason for that is that there are very few people that are able to afford a home without taking out a mortgage.

Alternatively, a credit card wouldn’t be considered “bad debt” but would be considered unnecessary debt.

In essence, we should have the money upfront for most things instead of using credit to purchase it, even if we’re going to use the credit card strictly to earn points or mileage.

That way we are not charged interest and paying someone else to use their money to purchase something we want or need.

By changing how you refer to debt and removing “bad debt” from your vocabulary, you no longer have to beat yourself up over having the debt. It’s only an object for you to remove, a milestone to conquer.

Removing the negative feelings and the stigma surrounding bad debt will clear up room for motivation. Negative feelings are always louder than good or motivating feelings. So let’s cut the bad ones out.

You are not a bad person for racking up debt. You are not stupid. Making some mistakes or hitting a rough patch does not define you.

You define you.

Set Lofty Goals

For those who don’t know me personally, I love setting goals. What are some of your goals? Is it to lose weight? Gain weight? Eat healthier? Get your financial life under control? Learn a new programming language?

Whatever your goals are, I encourage you to think big. Set big goals. Set lofty goals. If you aim low, you’re going to shoot low. If you are aiming for the stars, you’ll eventually reach the stars.

Think of it this way. The goal that you set is the ceiling. It’s the highest point you’re aiming for.

If you have a low ceiling, you don’t have a lot of room to move around. Your goal may be too easy. You may procrastinate to reach it because you know there’s no way you won’t attain it.

The 4-minute Mile

The 4-minute mile was something once thought of as impossible. In fact, it is now referred to as the “4-minute barrier.”

More than 60 years ago, one man no longer believed it impossible and trained to achieve this amazing feat. Finally, on May 6th, 1954 at the Iffley Road track in Oxford, England, Roger Bannister was the first man to break the 4-minute barrier. His exact time was 3 minutes and 59.4 seconds.

The amazing thing is that his record didn’t last very long! On June 21st of that same year, John Landy broke Roger’s record and ran a 3-minute 57.9-second mile.

Since then, the 4-minute barrier has been broken hundreds of times. In fact, there are some people who have run over one hundred sub-four-minute miles! The current record is 136 four-minute miles. That’s from one person!

What if the four-minute mile was never thought achievable? What if you no one decided to set their ceiling high enough, to set the goal high enough? It may never have been attained.

At the same time, if Roger had set his goal to be a five-minute mile, he may have achieved it and then stopped when he reached a 4 minutes 50-second mile.

If he set his goal for four minutes, even if he hadn’t achieved this but still ran a 4-minute 10-second mile, it is still lower than 4 minutes and 50 seconds.

Setting a high goal allows you to reach higher than you would with a smaller goal, even if you don’t quite reach it.

The higher your ceiling, the higher you’ll ultimately reach.

Financial Example

Let’s bring finance into this. Say I have $20,000 in credit card debt that I want to pay off. One card has $5,000, another has $6,000, and the third has $9,000.

Now, I don’t want to go too crazy, so instead of setting a goal of paying off the $20,000, I set my goal, or my ceiling, at that lowest card with $5,000.

I work hard and I pay off that $5,000. “YES! I made it! Now let’s take a break and do something else. I’ve reached my goal. I’m done for now.”

Do you see the danger there? When we reach a goal, our natural instinct is to stop. We’re done. We’ve made it. There’s an even bigger danger that if we set our goals too low. After we achieve them we go right back to what we were doing before.

So what should you do instead?

Steps

Set your goal to encompass all of what you want to do. If I have $20k in debt, my goal is to pay off $20k. The rest are steps to get you there.

Just like climbing to the roof, steps will make it easier to get there.

For our example debt of $20k, the individual credit cards are steps to help you reach your goal. Once I’ve paid off the $5,000 card, I’ve reached the first step.

I celebrate and keep going because my goal hasn’t been reached yet.

Viewing your smaller, individual debt as milestones or “steps” will help you to keep going. Don’t stop until you reach your goal, no matter how slow the going is. Keep climbing the steps!

As our pal Dory would say, “just keep swimming.”

Use Reminders

Constantly remind yourself how far you’ve come. Putting yourself down because of your debt is a barrier-free way to giving up. If you have $20,000 in debt, instead of beating yourself up that you have $15,000 left, tell yourself “good job” for paying off $5,000!

Better yet, use visuals!

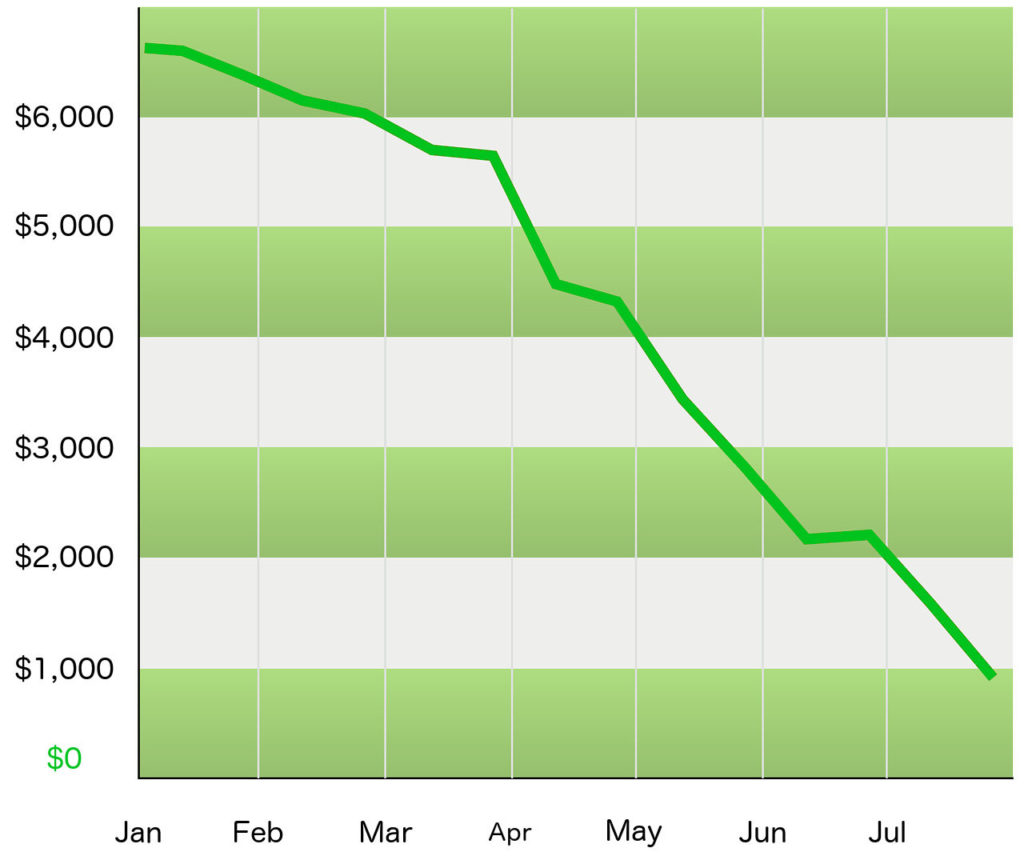

Create a line graph that you can use to track your progress every month. Programs like Microsoft Excel or Google Sheets can do this for you.

It might look something like this.

You can also create a physical line graph or bar graph on a whiteboard in order to track it by hand.

This may help you actually feel like you’re making progress because you’ll be having to write new (lower!) totals for your debt month to month, and draw in the bar graphs.

Each month, write your new debt total in the graph and then draw a line or bar to match the amount. As you continue to pay off your debt, you’ll be able to visually see your progress.

Having something to look at to remind you how far you come will keep you motivated to keep going.

Final Thoughts

Debt can be extremely stressful if not used properly. It can conjure up feelings that we normally don’t feel.

There is study after study and article after article that speaks to this. I think everyone who has had debt at one time or another has felt what it can do to you mentally.

It’s so important to be able to turn that stress around because debt has the ability to keep you in its grip simply by making you feel like crap. Use the ways above to be able to loosen its grip and start to take that stress and turn it into motivation.

The less time you spend with unnecessary debt the better.